Checks+Balanced: How to Budget for Early Retirement While Maintaining Healthy Habits

Do you know how much money your friends make? What about how much their rent is or how much is in their bank accounts right now? I'm guessing no. Even in a world where questions about menstrual cups and the ins and outs of sex are completely (and blessedly) normal to ask, somehow the ever-ubiquitous use of money remains a touchy subject for many. People want to live their healthiest life ever, but—#realtalk—it can add up. Have you ever wondered how your colleague who makes less than you do (or so you think) can afford to buy a $5 matcha and a $12 chopped salad every day? Or how your friend is able to hit up $34 fitness classes three times a week? It’s enough to make anyone want to ask, “Ummm, excuse me. How can you afford that?!?”

That’s where Well+Good’s monthly series Checks+Balanced comes in. By lifting the thick, tightly drawn curtain to expose how much women of varying income brackets spend on wellness, we’re spreading transparency and hopefully providing some inspo that’s possible to copy. Because no matter how much you make, it’s possible to cultivate healthy habits that work within your budget.

This month, meet *Leslie, a 37-year-old living in Hawaii with her husband and two kids. Leslie and her husband have a shared goal of early retirement, in 10 years. Leslie loves to eat healthy and work out, but because saving is her family's main goal, she's prioritized living simply. Keep reading to see how she makes it work.

{{post.sponsorText}}

Here, a 37-year-old living in Hawaii with her family shares her budgeting tips for early retirement.

Leslie, 37, homeschool teacher, Maui, Hawaii

Income: Works in exchange for housing, plus $3,600 for pop-up classes; husband is projected to make $250,000 this year. I homeschool my two sons, who are six and eight years old, and also my friend's three kids. In exchange for teaching my friend's kids, my family and I live in her guesthouse cottage for free. I also often teach pop-up homeschool classes to which other parents bring their kids. Subjects vary—for example, one was the life-stages of a butterfly—and there's a craft to go along with it with the lesson. These classes brings in about $300 a month. My husband is a contract employee, working remotely from home. He's in a new role and projected to make $250,000 this year, but it's not set, so it could be a little more or a little less.

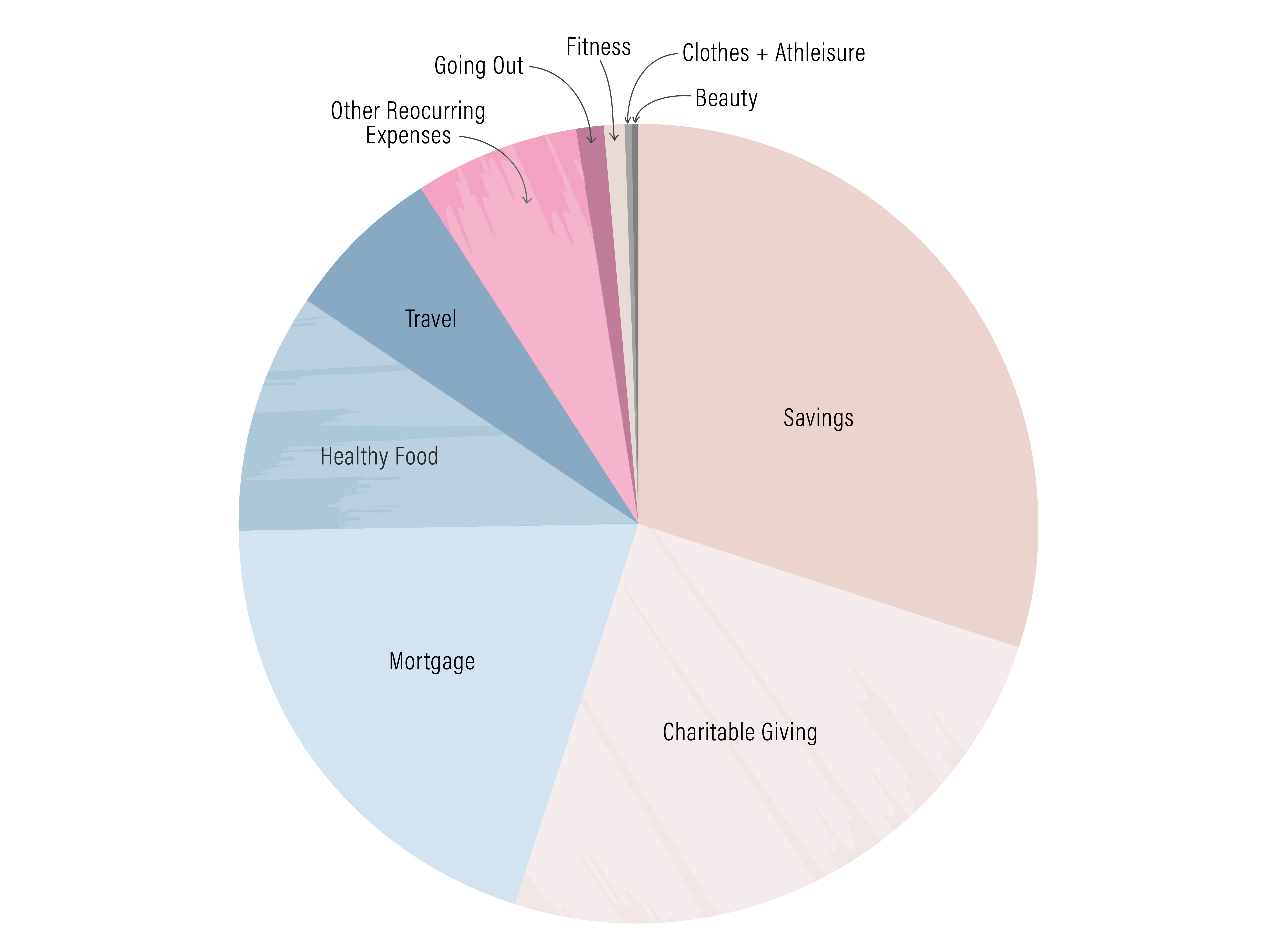

Mortgage: $2,500 per month. Even though my family lives rent-free in the cottage in exchange for my teaching, we own a house that we rent out for $2,500 a month, which is our monthly mortgage. But we pay an extra $2,500 a month on the mortgage because we want to pay it off early. I'm a big believer in living small. The cottage is only 500 square feet and the home we own is 750 square feet. We made these living choices intentionally: By living small, we're able to focus more on being financially independent and also giving more to our church and charity. This way, there's also less we need to clean, and we leave a smaller footprint on the planet.

Other reoccurring expenses: $804 per month. We don't have cable, but we do have Amazon. We also have Netflix, but we use my sister-in-law's account, and we let her use our Amazon account in exchange. Our cell phone bill is pretty pricey, at $192 a month. We had to get the best plan because the service in Hawaii is so bad. Dental visits are another big expense we have, paying $3,000 throughout the year for checkups, cleanings, and cavities. As far as transportation goes, our car is paid off, but gas can be expensive, adding up to about $266 per month. Otherwise, the only other reoccurring expense are the tools I need for homeschooling, which add up to about $1,000 per year.

Savings and investments: $3,800 per month. My husband and I are working toward early retirement, ideally in 10 years. To help make that happen, we dedicate $3,800 per month to savings and investments.

Charity: $3,125 per month. We reserve 15 percent of our income for giving to our church and other charitable opportunities that come up throughout the year.

Healthy food: $300 per week. My family follows a whole-food, plant-based nutrition plan. We try to limit our intake of processed foods and buy organic and local as much as possible. And, believe it or not, that can be especially tough to make happen while living on an island. Our grocery haul requires four different stops. (Buying everything from a farmers' market, which I would prefer, would be much too expensive.)

We get a lot of fresh fruits and vegetables from the farmers' market. Fruits that aren't grown locally, we get from Whole Foods or Costco, where we get many items (like peanut butter) in bulk. We also go to a local natural-food store for tomato sauce, pasta, and lentils, which we also buy in bulk.

Going out: $150 per month. My husband and I have a twice-a-month date night, and we spend about $50 each time. I also have girls' nights, which is a must for me—especially since I homeschool. I do that once a month, spending about $50 each time.

Fitness: $35 per month. I really like to mix up my workouts. Twice a week, my friend and I will do video workouts together, either from YouTube or my Jillian Michaels app, which I received as a gift. I also like going to Lagree Fitness—a high-intensity, low-impact workout—once a month. My family and I spend a lot of time outdoors, going hiking and taking nature walks, which, of course, is free.

Clothes and athleisure: $300 per year. Regarding clothes—for working out or otherwise—I aim to be minimalist. My husband has five shirts, I have three pairs of shoes, and the majority of clothes for our sons comes from clothing swaps. I probably spend $300 per year total for clothing the whole family.

Beauty: $100 per year. I don't wear much makeup, and I get my hair cut once a year, by my sister. When I do buy something—like a new mascara—I like to buy quality products that are organic, natural, and cruelty-free. There's a brand I like called 100% Pure.

Supplements: $100 per month. I spend about $100 per month on natural supplements and holistic remedies.

Travel: $10,000 a year. Both my family and my husband's family live on the mainland—fortunately only 45 minutes away from each other, so we can see everyone on the same trip. We visit once a year and we stay for a whole month. We save on flights by using points from our credit card, and we stay for free at my parents. We do tend to eat out a lot when we travel though, which does get pretty expensive. Besides the annual trip home, we also do one other big trip each year. All together, we spend about $10,000 a year total on traveling.

Meditation: $0. Having a healthy mind-set is very important to me. I pray a lot and enjoy positive affirmations, which I write in a journal and read aloud to myself when I'm drafting my goals. All of this is so important for keeping a peaceful mind, especially in today's world.

*Name has been changed.

If you're interested in early retirement, like Leslie and her husband, here are some tips on how to start investing, plus ideas for how to save more. If you want to be featured in Checks+Balanced, email emily@www.wellandgood.com.

Loading More Posts...