Checks+Balanced: What a 27-Year-Old in Chicago Making $103k Spends on Wellness—While Planning Her Wedding

Even in a world where questions about menstrual cups and the ins and outs of sex are completely (and blessedly) normal, somehow the ever-ubiquitous use of money remains a touchy subject for many. People want to live their healthiest life ever, but—#realtalk—it can add up. Have you ever wondered how your colleague who makes less than you do (or so you think) can afford to buy a $5 matcha and a $12 chopped salad every day? Or how your friend’s budget allows her to hit up $34 fitness classes three times a week? It’s enough to make anyone want to ask, “Ummm, excuse me. How do you afford that?!?”

That's where Well+Good's monthly series Checks+Balanced comes in. By lifting the thick, tightly drawn curtain to expose how much women of varying income brackets spend on wellness, we're spreading transparency and hopefully providing some inspo that’s possible to copy. Because no matter how much you make, it’s possible to cultivate healthy habits that work within your budget.

This month, meet Kayla, a communications specialist living in Chicago who makes $103,000 a year. She's also a part-time fitness instructor who's in the midst of planning her wedding, so living her healthiest life is a big priority—and her budget reflects that.

{{post.sponsorText}}

Here, a 27-year-old communications specialist and HIIT instructor shares how she spends on wellness.

Kayla, 27, corporate-communications specialist and fitness instructor, Chicago

Salary: $103,360 per year: $100,000 annually from the full-time job, plus $280 per month as a fitness instructor, teaching two classes a week.

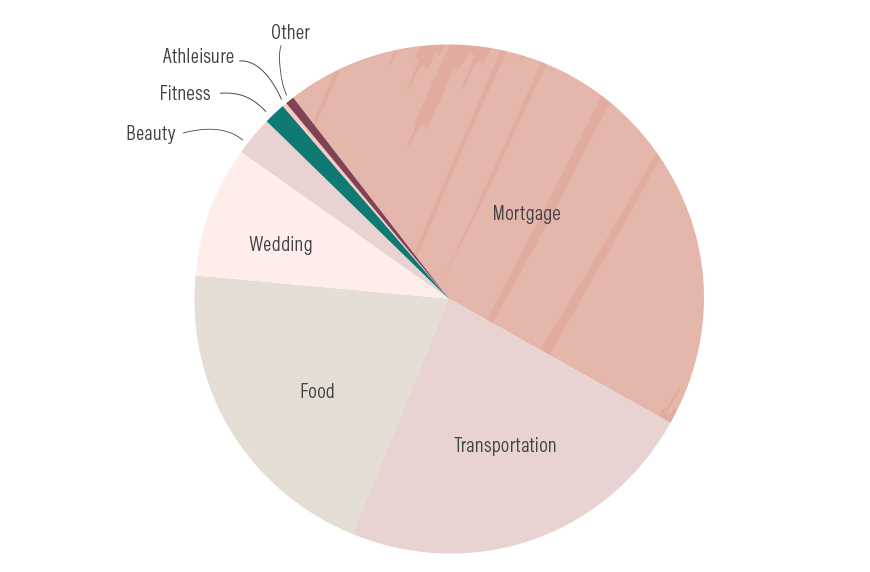

Mortgage: $1,300 per month. I live with my fiancé, and we put money down on a condo. The monthly mortgage is $2,600, which we split. We have identical salaries, so it makes the most sense.

Other big expenditures: $3,492 this year. My fiancé takes care of all of our utilities (cable, water, and electric), which comes out to $250 a month, while I handle the car expenses. The car lease is $280 a month, and our insurance is $117 a month. I also pay $15 a month for street parking. Living in Chicago allows us to walk to most places, so I only spend $40 a month on gas. We're getting married in Michigan in seven weeks (!!!), so we've been taking a lot of trips back. Between the tolls and gas, it's about $60 round-trip. We stay with our families though, so at least there's no expense for lodging.

The wedding has definitely been an expense for me—about $3,000 in the past year—even though our parents are paying for the big-ticket items, like our venue and the DJ. To help, I paid for our save the dates, invitations, and random extras, like our cake topper. Those little things really add up! Fortunately, I'm really good at budgeting. I use an old-school Excel doc to track spending, and I reference my debit- and credit-card statements weekly.

Food: $150 per month. I love to cook, and buying healthy food is really important to me. My fiancé? Not so much. So we have a deal that I pay for our groceries, and he pays for our date nights—which we do once a week. It's usually either at a reasonably priced farm-to-table restaurant (my pick) or a local taco joint (his go-to). We aren't so into fancy restaurants.

I budget $150 a week for our groceries, and I'm pretty strict with that. I don't follow a specific eating plan, but I prioritize buying foods made with ingredients I recognize. When I can, I like buying organic produce—especially for items on the Dirty Dozen list.

To stay within that $150 budget, I buy plant-based proteins—like legumes and fermented tempeh—instead of animal protein. It's cheaper and lasts longer. I also pack a lunch every day, and I love Siggi's yogurt so much, I have it almost every day as an afternoon snack. I really only drink alcohol when I'm celebrating something or being social—$7 bottle of Trader Joe's wine lasts me about a month and a half.

My fiancé works from home three days a week, so he eats leftovers on those days and then on the other two, he buys himself a sandwich. Both of our offices have free coffee—and almond-milk creamer—so we both just drink that in the mornings. Thanks, work!

Fitness: $51 per month. I teach a HIIT strength class twice a week, on Monday nights after work and Wednesday mornings at 6 a.m. I pay $10 a month for Spotify Premium—it would be pretty embarrassing if ads came on during my class, after all! I use Kayla Itsines' BBG app as teaching inspiration for my class and paid the full $100 at once because it was the cheapest option—so, broken down, it's about $8 a month. I also paid my annual gym membership in full upfront to get a discount. It was $400 for the year, which works out to about $33 a month.

Athleisure: $150 per year. I hardly spend any money on fitness clothing because that's what my fiancé and family always give me for Christmas and birthday gifts. A site I like called Gym Shark has some really big sales a few times a year, like on Black Friday, so I like to take advantage of that. I'd estimate I spend about $150 a year on athleisure.

Other wellness habits: $800 per year. Mindfulness and spiritual health are very important to me, but everything I do in that sphere is free. Every morning, I read the Bible and use this fantastic app called First5, which gives a daily devotion. It centers me in a way I never experienced before and it's completely free. Another way I stay centered is by taking walks outside—again, totally free.

I do get my hair done every three months—a trim and highlights—which costs $200 per appointment.

The bottom line: I feel my best when I'm eating wholesome, healthy foods and staying active—and my budget definitely reflects that. To afford these habits, I'm über-conscious of my money, staying on top of my monthly expenses and spending. Doing so has helped me budget for unexpected wedding expenses without sacrificing the healthy habits that are important to me.

Want to be featured in Checks+Balanced? Email emily@www.wellandgood.com. Plus, take a look at how much celebrities spend on wellness. And here's how to talk about money with your partner.

Loading More Posts...