Checks+Balanced: How a 27-Year-Old Freelancer in San Francisco Finances Her Wanderlust to Travel the World

Even in a world where questions about menstrual cups and the ins and outs of sex are completely (and blessedly) normal, somehow the ever-ubiquitous use of money remains a touchy subject for many. People want to live their healthiest life ever, but—#realtalk—it can add up. Have you ever wondered how your colleague who makes less than you do (or so you think) can afford to buy a $5 matcha and a $12 chopped salad every day? Or how your friend’s budget allows her to hit up $34 fitness classes three times a week? It’s enough to make anyone want to ask, “Ummm, excuse me. How do you afford that?!?”

That’s where Well+Good’s monthly series Checks+Balanced comes in. By lifting the thick, tightly drawn curtain to expose how much women of varying income brackets spend on wellness, we’re spreading transparency and hopefully providing some inspo that’s possible to copy. Because no matter how much you make, it’s possible to cultivate healthy habits that work within your budget.

This month, meet Michelle, a 27-year-old living in San Francisco who prefers the freelance life to a full-time gig largely because of the flexibility to travel it affords her. Check out how she juggles her responsibilities as a contract-based project manager, fitness trainer, and travel blogger. (She has great tips for how to travel cheap!) Keep reading to see her spending habits.

{{post.sponsorText}}

Here, a 27-year-old fitness trainer and freelance project manager living in San Francisco shares her creative tips for financing her world travels.

Michelle Razavi, 27, fitness trainer and freelance project manager, San Fransisco

Income: $108,000 per year. My primary job is a freelance project manager. I bounce around to difference contact positions, and I typically make $8,000 a month doing so. (In my experience, being a contractor has paid better than being a full-time employee). I also teach fitness classes at Equinox, making about $1,000 a month, in addition to a few freelance side gigs, bringing in roughly an additional $1,000 a month. I like being a contractor because it pays well and also gives me time and flexibility to devote to my travel blog. My goal is to be able to focus full-time on that.

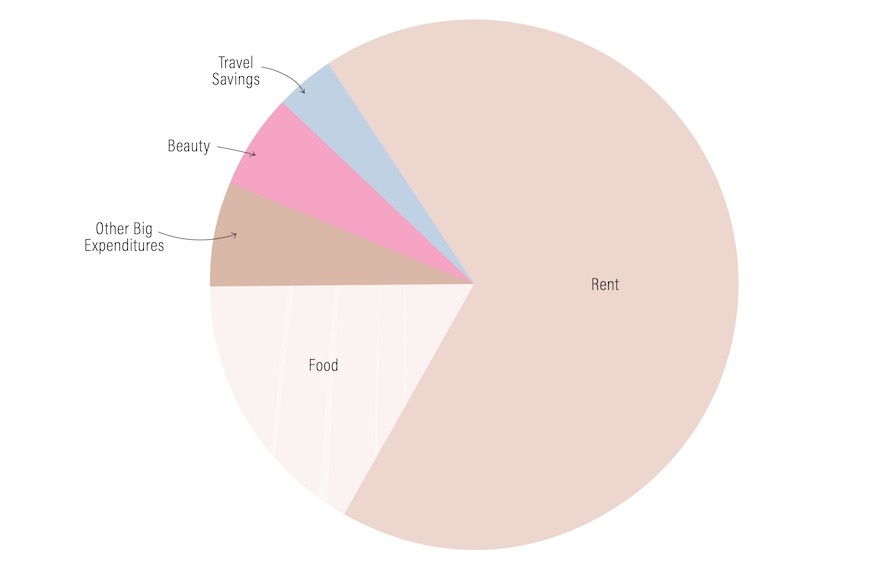

Rent: $1,650 per month. I have two roommates, and this is my share. It's actually a pretty good deal for San Fransisco—especially considering the fee includes some utilities.

Other reoccurring expenditures: $142 per month. I pay $40 for my portion of Wi-Fi, electricity, and gas, and another $50 for my phone bill. Otherwise, I don't have many other monthly expenses; I don't have Neflix or Hulu, and Equinox—where I'm a fitness trainer—pays for my Spotify so I can use it during classes.

I do have to pay for laundry, but try to keep that cost low by going to the laundromat about once a week, spending $8 each time. Still, it adds up! I don't own a car and spend roughly $20 on Ubers a month—fortunately San Fransisco is a very walkable city, and I travel on foot when possible.

Travel: $1,000 per year. Another reason I like being a contractor is that it affords me flexibility to travel when I can and want to. I'm currently working a lot, so I'm focused on shorter-term trips within the United States.

No matter how far I go, I try figure out how to travel cheap. A big way I conserve money is by being mindful about flight costs; I never spend more than $200 on flights—even for international travel. I do this by either using my [airline or credit card] points or jumping on "mistake flights." These mistake flights are available when a travel agent messes up and lists a flight for, $200 instead of $2,000, for example. To take advantage of this, I have to buy the tickets really quickly and be open-minded about where I'm going.

While I'm on a trip, I spend minimally, eat inexpensively, and limit the local fitness classes I take. I don't drink alcohol when I travel, because I feel more comfortable that way as a female solo-traveler. As a bonus, that choice saves me a lot of money.

Food: $400 per month. I really enjoy cooking and find it therapeutic. I buy most of my food at Trader Joe's, including basics like frozen blueberries, broccoli, salmon, turkey slices, and cool speciality items I've found, like dried carrot chips. I make a smoothie for breakfast every morning and put it in a mason jar so I can bring it to the gym. That way, I'm not spending $10 on a smoothie later. I rarely eat out because I prefer cooking and eating at home. I'm also sensitive to both dairy and gluten, so I try to be conscious of that.

Fitness: $0 per month. Being a fitness instructor means my workouts are built into my job. I also get to use the gym for free since I work there.

Beauty: $105 per month. I don't wear makeup because I'm at the gym teaching so much and would just sweat it off, but I do spend about $60 a year on beauty products such as facial cleansers and wipes. My one other beauty expense is dying my hair, which I do every month for $100 each visit.

Want to be featured? Email emily@www.wellandgood.com. And if you're thinking about becoming a fitness instructor, here's what to expect after you apply for the job.

Loading More Posts...