Checks+Balanced: a Massage Therapist Went From a 6-Figure Income to Zero Due to COVID-19

Well+Good’s monthly series Checks+Balanced was created to inspire more more openness about money. Because, for some reason, the ever-ubiquitous use of money remains a touchy subject for many, even in a world where questions about menstrual cups and the ins and outs of sex are completely (and blessedly) normal to ask. Because of this, you may well wonder how your friend affords tri-weekly yoga classes or your colleague with the same salary as you (or so you think) can buy fancy lunches every day. That's where we come in: By lifting the thick, tightly drawn curtain to expose how much women of varying income brackets spend on wellness, we’re spreading transparency and hopefully providing some inspo that’s possible to copy.

And while openness about budgeting, spending, and finances is always important, it's especially crucial right now during a pandemic when so many people are struggling financially. Below, Kathy Gruver, PhD, a massage therapist, hypnotherapist, and motivational speaker opens up about the drastic loss of income due to COVID-19 that she's experiencing right now.

Keep reading to see how a loss of income due to COVID-19 has affected Dr. Gruver's spending habits.

Kathy Gruver, PhD, 50, Santa Barbara, California

Income: $120,000 per year before COVID-19; currently $0. I'm an entrepreneur with my own massage therapy and hypnotherapy businesses, and I also frequently travel around the country for motivational speaking engagements. Obviously I can't travel to do my motivational speaking right now, and I'm also unable to meet with clients. While hypnotherapy could be done virtually (massage therapy couldn't), many of my clients have also experienced a loss in income due to COVID-19 and can no longer afford appointments.

{{post.sponsorText}}

My father passed away a year ago, leaving me a few thousand dollars, which is what I'm living on right now. I also got my $1,200 stimulus check in the mail, but it's not going to go very far. I tried to apply for unemployment, but the website was not set up for self-employed workers, and when I called in for help, I got an automated message essentially telling me they were busy. So regarding income, I'm still trying to figure out what to do.

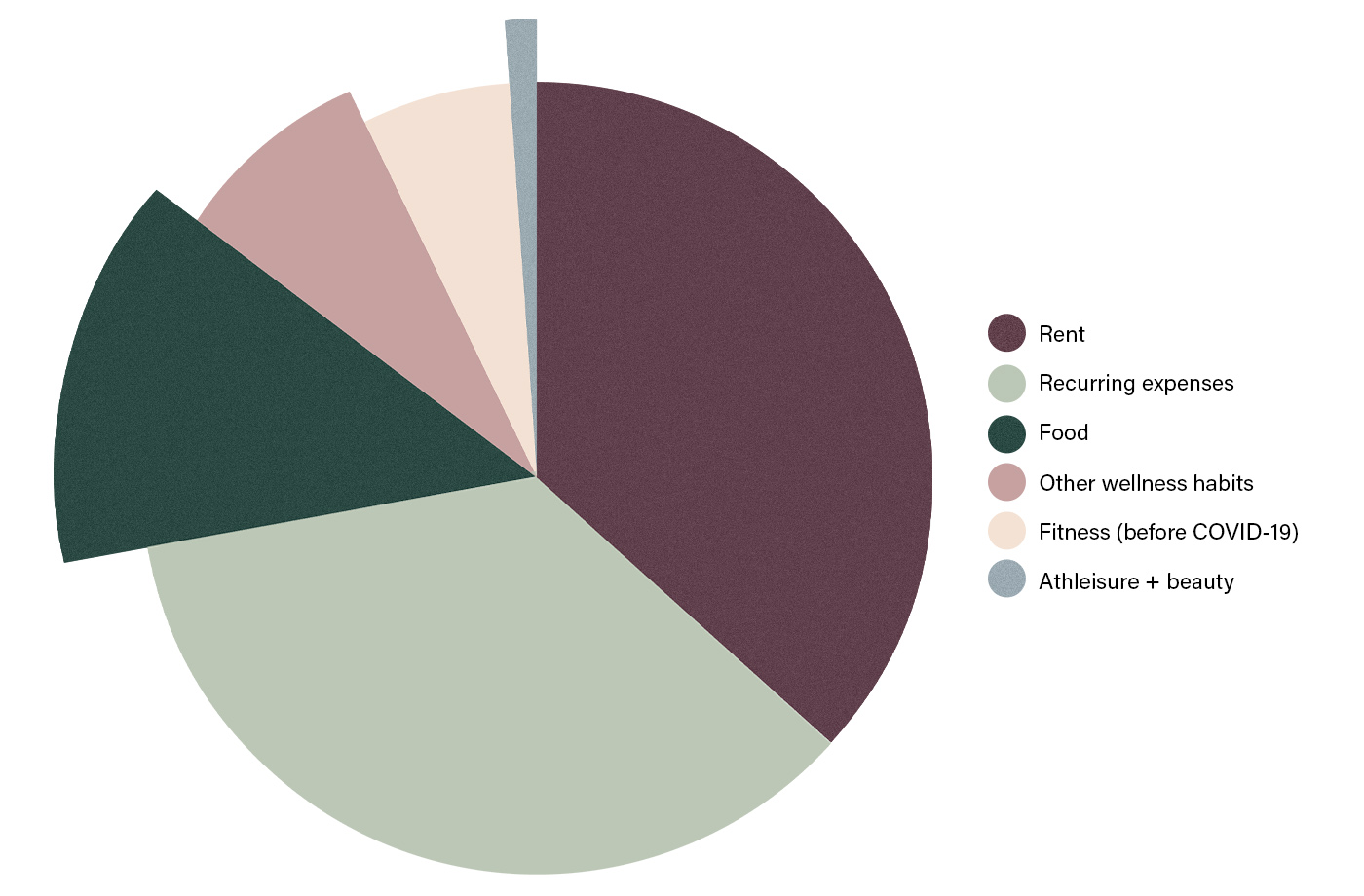

Rent: $1,550 per month. I'm recently divorced, and my new boyfriend and I are quarantining together in my one-bedroom loft. He still has his own apartment, so I'm paying my full rent on my own.

Other recurring expenses: $1,493 per month. I rent an office for my massage therapy and hypnotherapy, which costs $500 per month. Even though I'm not using it right now, I'm still required to pay rent. Fortunately, the landlord is an old friend, so I may talk to him about deferring my rent payments until after the pandemic. My other monthly expenses are $300 for health insurance, $350 for my monthly car payment, $130 for my phone, $200 for cable and internet, and $13 for Netflix.

Food: $550 per month. I like to eat healthy, and I really like to cook, which I've been able to do a lot more of during the pandemic because I'm home more and not traveling. Normally I do my grocery shopping at Trader Joe's, but the line there has been really long, so I've been going to Grocery Outlet, where I'd never shopped there before the pandemic. It might be my new favorite place, though. (It has a great wine selection.)

Some of my favorite foods to make are pesto pasta, chicken, and breakfast foods of all types. I would estimate that I spend about $100 a week on groceries. I don't really eat out (or order in, as the case is now) unless it's a special occasion or I'm traveling. I also have a membership to a wine club, which costs $1,800 a year.

Fitness: $260 per month before COVID-19; currently $0. I'm a trapeze artist, and there's a trapeze rig in Santa Barbara that I used to go to pretty frequently. I actually just had my seven year fly-versary! I pay $1,600 for 20 classes at the trapeze rig (it's $80 a class), which normally lasts me about five months, and that's on hold now. I also have a gym membership on hold, which was $180 per month and I took hip-hop dance classes at the gym. So those are expenses I don't have right now.

I have a trapeze in my living room, so I still use that at home. My goal is to be able to do a pull-up by the time the pandemic is over.

Athleisure: $300 per year. I'm not big into buying athleisure or workout clothes, but I do have quite a collection of socks and leggings for trapeze. Normal, I shop just twice a year for what I need.

Beauty: $200 per year. I'm not really into makeup, but there are a few skin-care products by Dr. Dennis Gross I buy a few times a year, like his eye cream and daily facial cloths.

Other wellness habits: $310 per month before COVID-19; currently $300 per month. I meditate (for free) every morning, whether for just a few minutes or for 20. I still see my chiropractor weekly because he is considered an essential worker, and it costs $75 a session. (Between trapeze and my massage work, I'm pretty hard on my body, so it's important to me to go.) I also get acupuncture on an as-needed basis (about five times a year), such as if I'm feeling sick. It's $50 a session and I've gone a few times during the pandemic for some back issues. One thing I am struggling with is being unable to give as charitably as I did before the pandemic, because I don't have the income to do so now.

And in general, I worry about how long the pandemic will last and whether I will be able to sustain my finances for the duration since I'm unable to work. Whenever it does ends, I know I will have to work even more and harder than before to make up for not only the lapse in income, but also the pause in the momentum that I worked so hard to build around my career. And while these factors drive feelings of anxiety, they also serve as a reminder that it's dangerous to put your identity into anything external, because that external bucket could go away at any time.

If you want to be featured in Well+Good's Checks+Balanced series, email emily@www.wellandgood.com.

Loading More Posts...